Aimed at addressing the longstanding challenges faced by Filipino youth in accessing credit, Zed, a pioneering credit-led neobank, has introduced the first credit card specifically designed for young Filipino professionals. The announcement comes amidst growing demand for accessible financial products among the country’s Gen Z population.

Despite the ongoing digitalization efforts in the financial sector, many Filipinos continue to encounter barriers when seeking credit solutions. According to a recent study by TransUnion Philippines, while 94% of Filipino Gen Zs recognize the importance of credit and lending products for achieving their financial goals, only 35% report having adequate access to such services.

“If you talk to any Filipino, there’s still significant frustration with the complexity, lack of transparency, and bureaucracy embedded in financial services. Only 8% of Filipinos own a credit card, largely because it is incredibly difficult to get one if you don’t already have one. We founded Zed on the belief that young people in the Philippines and Southeast Asia deserve better financial products, better technology, and ultimately better service tailored to their lifestyles and exceeding their expectations,” according to Danielle Cojuangco Abraham, Zed co-founder.

The conventional hurdles of complex application procedures, extensive documentation requirements, and arbitrary underwriting standards disproportionately affect young individuals seeking their first credit cards. Those fortunate enough to secure approval often face exorbitant annual percentage rates (APRs), punitive fees, and subpar customer experiences.

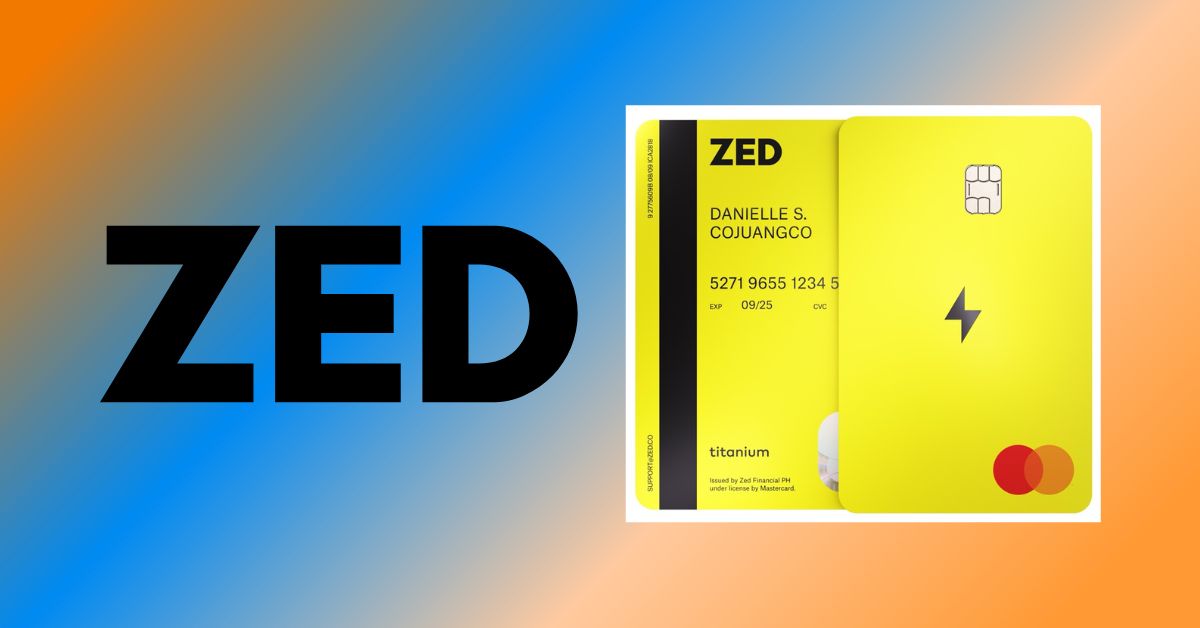

Recognizing these challenges, Zed emerged as a beacon of innovation in the financial landscape. Founded by two Stanford engineers and Y-Combinator alumni, Zed operates under the regulatory oversight of the Bangko Sentral ng Pilipinas (BSP). The neobank’s flagship offering is the Mastercard Titanium credit card, featuring a host of unprecedented benefits including zero interest, no foreign transaction fees, and no annual fees.

What sets Zed apart is its cutting-edge mobile application, empowering customers with unparalleled control over their finances. The app provides real-time transaction monitoring, customizable spending limits, and advanced fraud prevention measures such as card freezing capabilities. In addition, Zed prioritizes user privacy and security by offering unlimited virtual cards, shielding primary card details from potential breaches.

“As a technology company from day one, we don’t have to pay for costly overhead like physical branches or bloated headcounts for manual, back office processes. We’re able to pass these savings on to customers in the form of no revolving interest, no fees, and excellent customer service. We started Zed on the premise that you could build financial services where a customer’s success was a core value,” said Steve Abraham, Zed co-founder.

The response to Zed’s launch has been overwhelmingly positive, with nearly 25,000 individuals signing up on the waitlist within the initial three weeks. The neobank’s customer-centric approach, tailored to the Gen Z lifestyle, resonates strongly with the Filipino populace.

Zed streamlines the credit card application process, enabling users to complete it seamlessly within minutes through the mobile app, eliminating the need for cumbersome paperwork or branch visits. By eschewing traditional credit scoring models in favor of a more holistic assessment based on income potential, Zed ensures equitable access to credit for young professionals with limited credit histories.

With its innovative features, commitment to user empowerment, and dedication to financial inclusivity, Zed represents a transformative force in the Philippine banking sector. For more information and to join the waitlist, interested individuals can visit the Zed website at zed.co.