The country’s leading digital bank, Union Bank of the Philippines (UnionBank), continues to invest in talent, infrastructure, and other resources needed to innovate and co-create with the use of Data Science and Artificial Intelligence.

Data Science and Artificial Intelligence (or “DSAI”) are “tandem”-technologies that are now taking over many industries across the globe. Many exciting prospects have ushered more personalized, “tailor-fit” digital experiences for many of us, thanks to Artificial Intelligence. This has made many of the things we do in our lives simpler, more instantaneous, and, thus, more convenient.

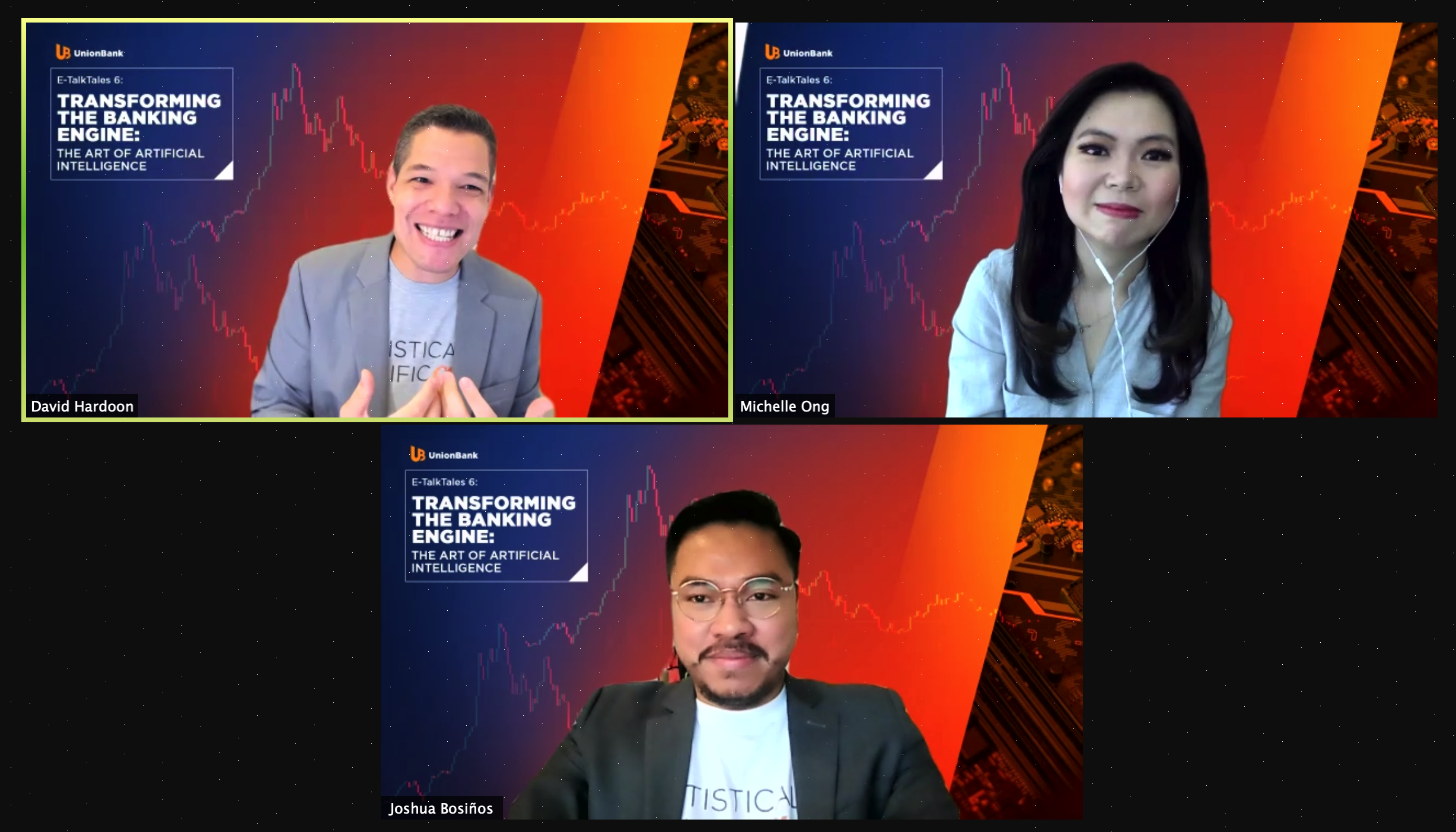

During the sixth installment of UnionBank’s exclusive “eTalk Tales” with members of the press and media, global data science expert Dr. David Hardoon Ph. D. — the bank’s Senior Advisor for Data and Artificial Intelligence — tackled how UnionBank is translating data science and artificial intelligence insights into a very individualized way of banking, making sure that everyone is statistically significant and provided the “VIP” treatment with a wide range of personalized services and solutions.

“DSAI is a key element within UnionBank’s digitize or perish journey. It is the differentiator between just ‘digitize to survive’ versus ‘Digitize to flourish’,” according to Hardoon.

With the goal of making finance relevant, specific, and contextual to each individual consumer, Hardoon can only emphasize why AI is a must-have for the bank to scale based on the premise of a customer-centric finance of tomorrow.

Hardoon’s use of AI is not artificial intelligence but “augmented intelligence,” according to the former Chief Data Officer of the Monetary Authority of Singapore (MAS). The reality is that humans are phenomenal in creativity that machines do not have. Machines may be able to replicate but it cannot originate. This, according to Hardoon, is where augmentation comes in. Data science uses insights from machines to operationalize and contextualize.

“AI is the engine of the digital renaissance. It is a vehicle to achieve an aspiration. It is important to anchor AI on what truly matters — people, whether customers or employees. AI is truly about being human-centric first. The purpose is us, primarily as customers, and how do we leverage on the insight and knowledge that can be derived from AI to help shape financial services around us.”

Digital transformation is heralded as the game-changer for the banking sector in today’s reality and for tomorrow’s necessity. The transformation is rooted in the aspiration of inclusive and resilient financial services and is about achieving a reality where ones’ moments of life are not defined around the financial products available, but where financial services and products are created to support the milestones in life.

“The Bank has been introducing and enhancing countless digital touchpoints for customer ease and fluidity of engagement. These touchpoints mean exactly that, that customers engage with the Bank on a more regular basis. It is our responsibility to…imagine. Imagine the ability to provide bridging or intra-day loans without a customer’s need to submit hefty financial historical statements,” Hardoon said.

UnionBank uses AI to upgrade its existing strategy and accelerate further innovation, an example of which is its use as an additional layer of defense against financial crimes. AI enables the Bank to detect more instances while making sure that the existing defense and process will not be disrupted to ensure operational efficiency. Leveraging on AI, the bank is able to predict future volume of inbound calls that can reduce some of the volatility in call management. The bank’s cash management solutions team can now provide customers with data-driven relevant recommendations and proposals faster than before.

DSAI enables capabilities in understanding customers’ needs through their various engagements with the bank and providers and the ability to go beyond a templatized approach to ascertain relevance, suitability, and affordability, making UnionBank the country’s best bank in the data science and AI field.

UnionBank President and CEO Edwin Bautista believe that leveraging Data Science and Artificial Intelligence is a key driver to the next level of its digital transformation as the Bank continues to put the customer — both individuals and corporates, at the heart of its business.