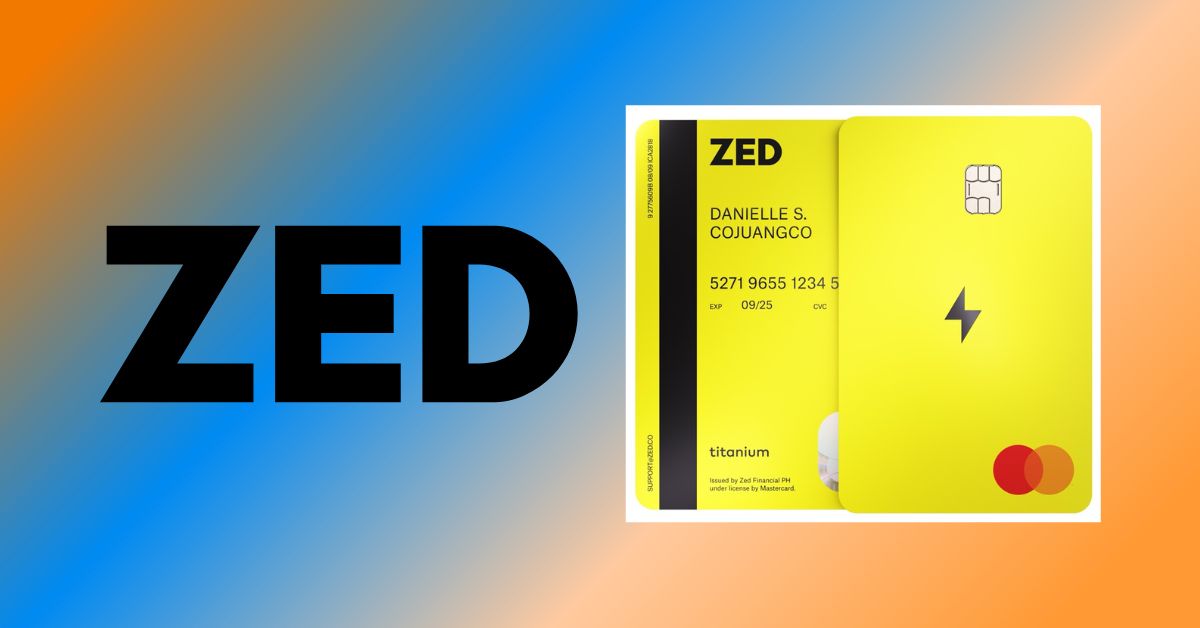

Zed, a credit-focused neobank in the Philippines, has secured its license to operate as a standalone credit card issuer from the Bangko Sentral ng Pilipinas (BSP). This makes Zed the first Philippine neobank to offer its own credit card product.

“Our BSP license makes us the first Philippine neobank to offer credit cards as a standalone issuer. This independence and our foundation as a technology company mean we can rapidly and continuously improve our product, unconstrained by legacy systems,” according to Danielle Cojuangco Abraham, Zed co-founder and CEO.

Following a successful pilot program approved by the BSP, Zed is officially launching its Zed Card to the public. However, the rollout will be on an invite-only basis, starting with the nearly 40,000 Filipinos who signed up for the waitlist since its launch in March 2024.

The Zed Card has garnered significant interest due to its unique features:

- No fees: Zed has no annual fees, foreign transaction fees, or any other hidden charges. Users only pay for the purchases they make.

- No revolving interest: Zed cardholders enjoy an interest-free grace period of up to 31 days, eliminating the risk of accruing interest on outstanding balances.

Beyond its fee-free approach, Zed introduces a revolutionary method for determining credit limits:

- Smart credit limits: Instead of relying solely on traditional credit scores, Zed analyzes a user’s current and potential income, along with other data points, to establish credit limits. This empowers young professionals with limited credit history to build their credit responsibly without limitations based solely on traditional scores.

“We’ve seen really strong engagement among our early cardholders, with transaction volume growing 100% month over month and 48% of cardholders transacting daily. We’re committed to delivering an exceptional customer experience, and our early usage data confirms that the next generation craves a completely different credit card experience – one that eliminates expensive fees, promotes responsible spending, and offers seamless control over their accounts,” said Zed co-founder Steve Abraham.

Zed has secured US$6 million in seed funding from prominent investors, including Peter Thiel’s Valar Ventures, founders and operators from Nubank, Mercury, Cred, and Square.