GCash posted an impressive 254% Year-on-Year growth for 2020 after hitting its PHP1T transaction commitment earlier this year. The undisputed leader and most preferred mobile wallet in the Philippines exceeded its 2020 business targets as it continues to empower millions of Filipinos with digital financial tools and services to help them adapt to the new normal.

“The remarkable growth GCash experienced this year shows that Filipinos have embraced financial technology. People have realized that fintech isn’t just an option but a necessity, allowing them to fulfill their financial lifestyle conveniently,” according to Martha Sazon, President and CEO of GCash.

At its peak, GCash had a PHP7.5B daily gross transaction value with more than 6 million transactions per day. For its customer base, the year 2020 saw an increase to 33 million from just 20 million in 2019.

GCash’s exponential growth is attributed by Sazon to people’s readiness to shift to cashless, consumers finding fintech a necessity during the pandemic, and by providing consumers a great journey within their ecosystem, making financial services as easy as messaging. The growth is driven by an unprecedented surge in usage in GCash to GCash money transfers, bank transfers, online and offline cash-in services, and bill payments, all of which have become necessities during the pandemic.

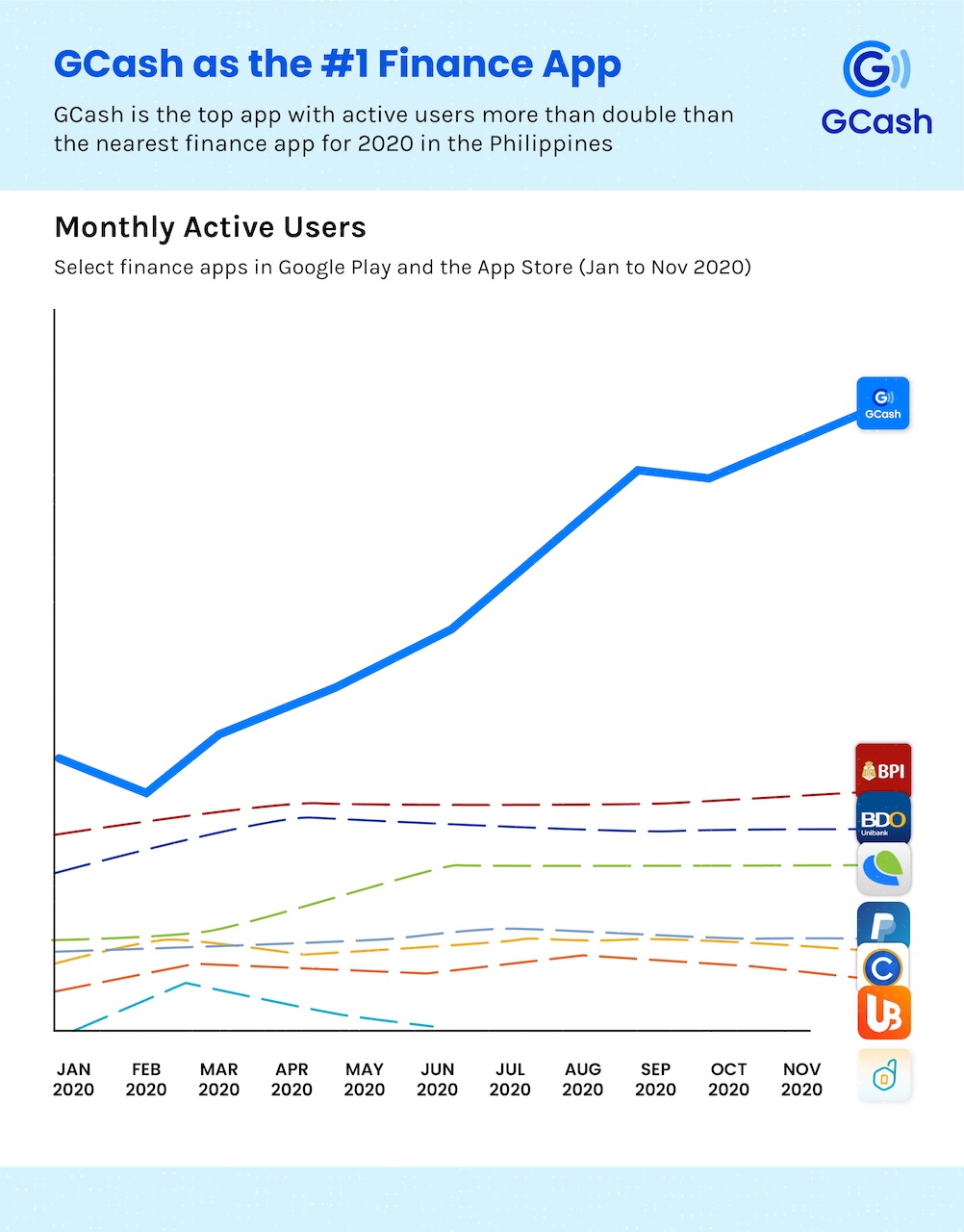

Data from third-party global app ranking firm App Annie showed that GCash has been definitely the number one mobile wallet in the Philippines for eleven (11) consecutive months in 2020. Their data also showed that the GCash app also overtook popular streaming and social services such as Netflix, Twitter, Grab, and TikTok. This reflects the Filipinos’ growing reliance on digital finance to manage their personal finances and to carry on with their daily lives while also staying safe with contactless transactions provided by fintech apps like GCash.

“We observed that Filipinos rapidly adopted GCash while they adjusted to the stay-at-home lifestyle, and have meaningfully impacted their lives. Thanks to GCash’s pivot to fulfill the needs of its customers during the new normal, our growth reached remarkable heights in a span of a few months,” added Sazon.

Part of the strategies driving the mobile wallet’s PHP1T transaction value growth further is its participation in popular culture and traditions, such as the global 12.12 online sales, and even replacing physical red envelopes — ang paos — with its very own digital version, prompting Filipinos to send money to their loved ones during the holiday season using the GCash app.

GCash is also leading the financial service sector, by inducing more than 3 million Filipinos to open their own savings accounts through GSave as of November 2020 and have extended over PHP 8 billion in much-needed credit through GCredit. The growth in these services demonstrates the positive disruption being provided by financial technology in the country, offering vast convenience to its customers.

GCash’s performance in 2020 accelerates the fulfillment of the Bangko Sentral ng Pilipinas’ Digital Transformation Roadmap, where the agency aims to shift at least 50 percent of retail payment transactions to digital and to have at least 70 percent of Filipinos have their own e-wallet by 2023.

During the first seven (07) months of 2020, GCash hit a record PHP100B transaction value and has disbursed over PHP16B SAP disbursements to 2 million Filipinos nationwide.

Globe Fintech Innovations Inc. (Mynt), which operates GCash, is part of the portfolio companies of 917Ventures, the largest corporate incubator in the Philippines wholly-owned by Globe Telecom Inc.

GCash is available for download on the App Store and Google Play.